If you are looking for a new home, you can get a pre-approved mortgage. With a mortgage pre-approval, a licensed mortgage professional can do a more complete verification prior to sending you shopping for a home, and with that done, the dollar figure you are going shopping with is actually what you can spend.

The mortgage professional that you work with to get pre-approved will let you know for certain what you can afford based on lender and insurer criteria, and what your payments on a specific mortgage will be. Acer Mortgage Lending Corp mortgage professionals can lock-in an interest rate for you for anywhere from 60 to 120 days while you shop for your perfect home. By locking in an interest rate, you are guaranteed to get a mortgage for at least that rate or better. If interest rates drop, so will your locked-in rate. However, if the interest rates go up, your locked-in interest rate will not, ensuring you get the best rate throughout the mortgage pre-approval process.

In order to get pre-approved for a mortgage, a mortgage professional requires a short list of information that will allow them to determine your buying power. A mortgage professional will explain to you the benefits of shorter or longer mortgage terms, the latest programs available, which mortgage products they believe will most likely meet your needs the best, plus they will review all of the other costs involved with purchasing a home.

Getting pre-approved for a mortgage is a good option for home buyers before going shopping for a new home. A pre-approval will give you the confidence of knowing that financing is available, and it can put you in a very positive negotiation position against other home buyers who aren’t pre-approved.

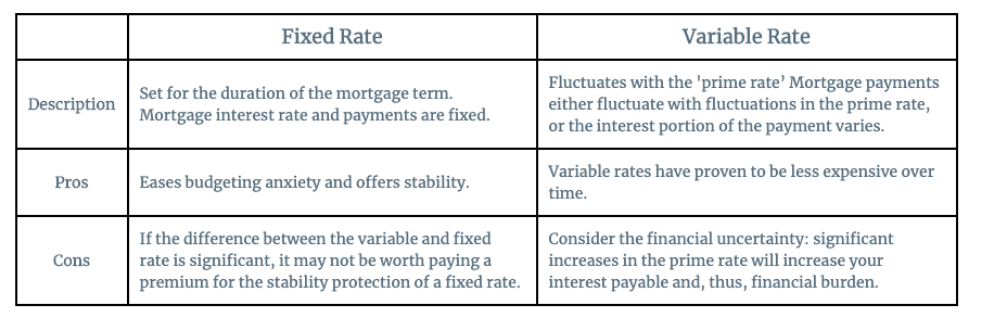

Choosing the mortgage term that is right for you can be a challenging proposition for even the savviest of homebuyers. By understanding mortgage terms and what they mean in dollars and sense, you can save the most money and choose the term that is right for you.

There are many factors, either in the financial markets or in your own life, which you will also have to take into consideration when you select your mortgage term length.

If paying your mortgage each month places you close to the financial edge of your comfort zone, you may want to opt for a longer-term mortgage, for instance ten years, so that you can ensure that you will be able to afford your mortgage payments should the interest rates increase. By the end of a ten- year mortgage term, most buyers are in a better financial situation, have a lower principle balance due, and should interest rates have risen, will be able to afford higher mortgage payments.

If you are shopping for a mortgage for an investment property, you will likely want to consider choosing a longer mortgage term. This will allow you to know that the mortgage payments on the property will be steady for a long time and allow you to more accurately project your future income from the property.

Choosing the right mortgage term is a unique decision for each individual. By understanding your personal financial situation and your tolerance for risk, a mortgage professional can assist you in choosing the mortgage term which will work the best.

Mortgages in Canada are generally amortized between 25 and 35-year terms. While this seems a long time, it does not have to take anyone that long to pay off their mortgage if they choose to do so in a shorter period of time.

With a little bit of thinking ahead, and a small bit of sacrifice, most people can manage to pay off their mortgage in a much shorter period of time by taking positive steps such as:

Making mortgage payments each week, or even every other week. Both options lower your interest paid over the term of your mortgage and can result in the equivalent of an extra month’s mortgage payment each year. Paying your mortgage in this way can take your mortgage from 25 years down to approximately 21.

When your income increases, increase the amount of your mortgage payments. Let’s say you get a 5% raise each year at work. If you put that extra 5% of your income into your mortgage, your mortgage balance will drop much faster without feeling like you are changing your spending habits.

Mortgage lenders will also allow you to make extra payments on your mortgage balance each year. Just about everyone finds themselves with money they were not expecting at some point or another. Maybe you inherited some money from a distant relative or you received a nice holiday bonus at work. Apply this money to your mortgage as a lump-sum payment and watch the results.

By applying these strategies consistently over time, you will save money, pay less interest and pay off your mortgage.