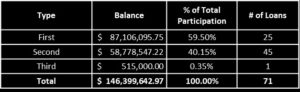

As of June 30th, 2020, Gentai Capital has managed GMIC for over 7 years and 9 months, funding 374 mortgages totalling $457.90 million, successfully achieving the target annual return of 8.24%*, and consistently paying dividends (31 dividends + 2 special distribution) with total dividends paid of $36,364,530. * There is no guarantee of performance. Past performance may not be repeated.

GMIC Performance (Quarterly) As of June 30th, 2020

Highlights of the Quarter:

- Total mortgage interest of $3.60 million.

- Regular quarterly dividend continues at $0.02 per quarter- $0.08 annual rate, plus a special dividend at year-end, as determined by the board of directors.

- The loan portfolio has an average Loan to Value (LTV) of 19%.

- Mortgage portfolio of $146 million.

Continued focus on low-risk real estate sectors

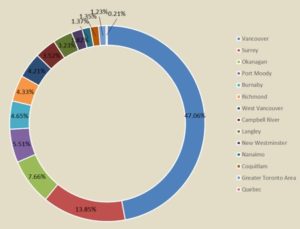

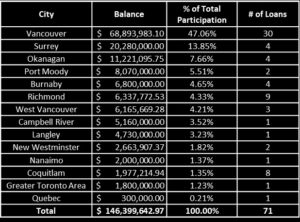

By Geographic Location:

- Mortgage properties are concentrated in central urban areas; Vancouver, Surrey accounted for the top two.

- Central urban areas are preferred locations where the real estate market is active and less volatile.

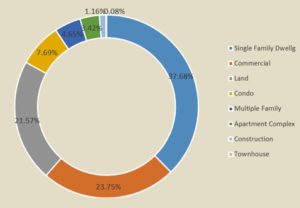

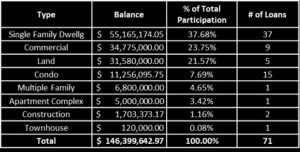

By Mortgage Type:

- Mortgage types include single houses, townhouses, condos, commercial, land and construction. Single houses consisted of 68% of the mortgage portfolio. Diversification in investments is expected to lessen the risks involved.

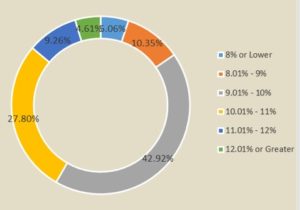

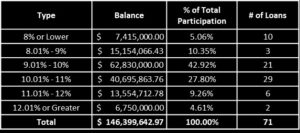

By Mortgage Interest Rate:

- As of June 30th, 2020, the average mortgage interest rate is 22%.

- Gentai Capital applies strict control in risk management throughout the loan process. Due to the strict and robust lending policy, Gentai Capital has not only consistently achieved an 8.24%* return for investors in seven years and nine months but also strictly controlled the potential risks involved to generate such a high rate of return.

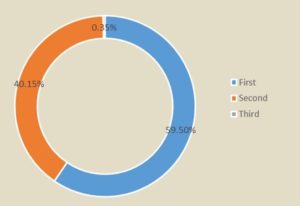

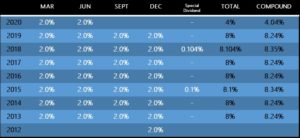

By Mortgage Position:

- Firs position over 59.50%.